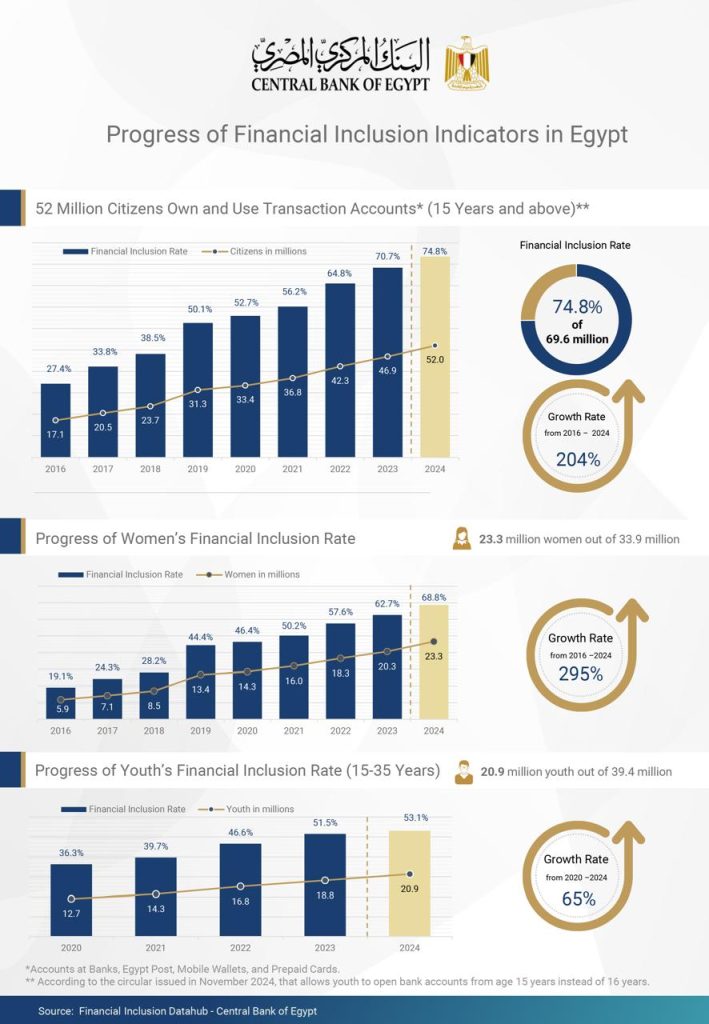

Financial inclusion rates in Egypt continued their upward trend, marking one of the best performers among peer countries. The number of citizens who own and use active accounts that enable them to perform financial transactions – whether banks, Egypt Post, mobile wallets, or prepaid cards – reached around 52 million citizens out of 69.6 million eligible citizens (aged 15 years and above). It is worth noting that the Financial Inclusion rate incorporates only citizens who use their accounts that enable them to manage their finances effectively.

The remarkable increase comes in light of the Central Bank of Egypt’s (CBE) continuous efforts, in collaboration with the banking sector and relevant stakeholders from ministries and authorities, to achieve economic empowerment for all segments of society, particularly women, youth, people with disabilities (PWDs), and entrepreneurs.

By the end of 2024, financial inclusion rates reached 74.8%, compared to approximately 70.7% at the end of 2023, reflecting a growth rate of 204% throughout the period from 2016 to 2024. This was achieved despite the growth of the citizens’ base who are eligible to open accounts, as a result of issuing the CBE’s circular to amend the minimum age for youth to open bank accounts from 16 to 15, which comes in line with adjusting the age for issuing National IDs.

At the women’s financial inclusion forefront, the number of women who use transaction accounts has amounted to 23.3 million women out of 33.9 million, reflecting a growth rate of 295% compared to 2016, with the financial inclusion rate for women reaching 68.8%. Similarly, the financial inclusion rate of youth (aged 15 to 35 years), comprising 39.4 million youth, has increased to 53.1%, marking a growth rate of 65% throughout the period from 2020 to 2024.

Worth mentioning that the financial inclusion regulations concerned with facilitating account opening for individuals and handicraftsmen using only their National IDs, resulted in opening nearly 1 million financial inclusion accounts for individuals, in addition to 400,000 “Economic Activity Accounts” throughout the period from 2022 to 2024, enabling them to execute their financial transactions within the formal sector. This comes in line with the CBE’s directions, to focus on the excluded segments to ensure their access to the financial services with adequate quality, cost and effective usage of these services.

The core set of financial inclusion indicators issued by the CBE plays a vital role in monitoring the progress of financial inclusion rates effectively, as well as enabling the development of supportive policies to achieve the economic empowerment of citizens as part of the exerted efforts on the national level, in alignment with Sustainable Development Goals and Egypt’s Vision 2030.

The growth of financial inclusion rates in Egypt over the past years reflects an increase in the citizens’ benefits of financial services that are suitable for them, encouraging savings, facilitating financial transactions with reduced time and cost, and ensuring the availability of services anytime and anywhere. This contributes to improving the livelihoods of citizens, as well as promoting the economic empowerment of women and youth.