As global markets respond to the latest U.S. tariffs on steel and aluminum, a new white paper from Betterhomes titled Will Trump’s Tariffs Impact UAE Real Estate? explores the indirect effects of recent trade policies on the UAE economy and highlights why Dubai continues to stand out as a safe, long-term investment destination.

Dubai’s real estate sector remains resilient, continuing to draw strong interest from international investors. According to the previous report Dubai: No Longer a Pit Stop, But the Finish Line for Global Wealth, the city has attracted more relocating millionaires than any other in the world, a testament to its growing appeal as a premier destination for both luxury living and strategic property investment

“At Betterhomes, we’ve seen a noticeable shift since the tariffs were announced. Interest from the US and China is up by more than 40%, and website traffic from those markets has surged by 60%. It’s clear that investors are seeing Dubai as a stable and strategic place to put their capital.” said Louis Harding, CEO at Betterhomes.

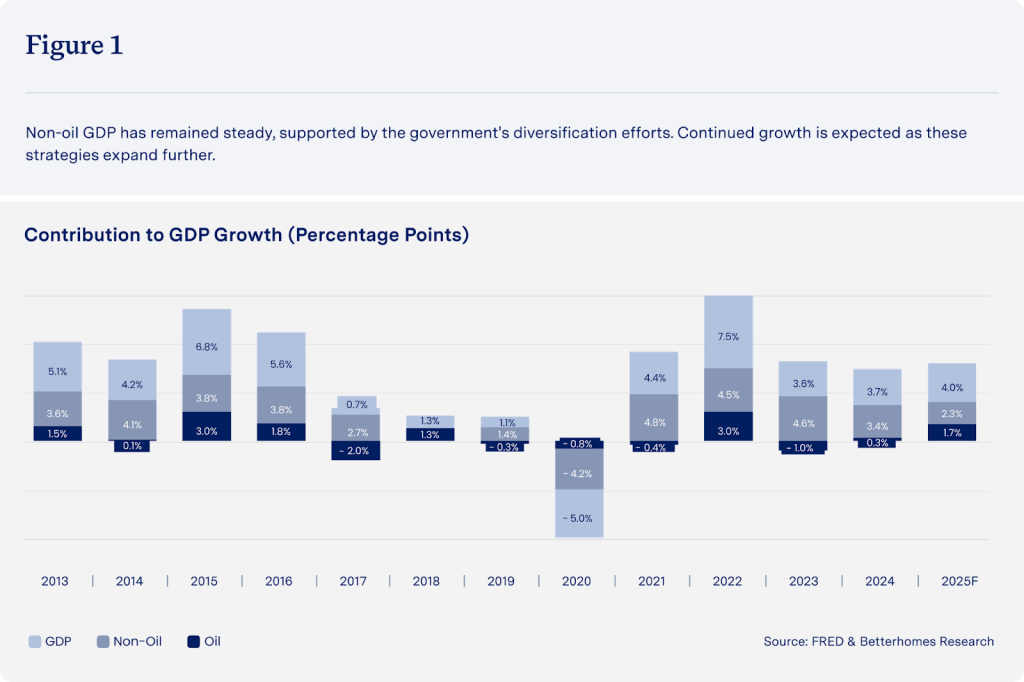

The UAE’s economic outlook remains positive, with growth supported by rising oil production, a booming tourism industry that brought in 19 million visitors in 2024, and more than 3,500 active infrastructure and real estate projects. A population of 12 million, including 4 million in Dubai alone, continues to grow steadily. The country is also the second-largest supplier of aluminium to the US, exporting 350,000 tonnes in 2024, a key contributor to industries like aerospace, automotive, and real estate.

Dubai’s long-term vision is anchored by strong government planning. Initiatives are already in motion to double foreign investment to $65 billion by 2031, across key sectors such as logistics, finance, renewable energy, and technology. The city’s Real Estate Strategy 2033 aims to increase housing supply, grow homeownership to 33%, and double the real estate sector’s share of GDP.