Contact Financial Holding (CNFN.CA), Egypt’s leading non-bank financial services provider, announced today its consolidated financial results for 1Q25. The Group delivered a strong start to the year, boasting a solid 30% y-o-y increase in consolidated operating income, to reach EGP 475 mn, while net income surged by 306% y-o-y closing the first quarter at EGP 59 mn.

“Contact’s strong first-quarter results reflect the impact of our strategic pivot toward higher-margin products and the resilience of our business model, supported by gradually improving economic conditions, The Group net income surged by an impressive 306% y-o-y increase, coupled with the exceptional performance from our insurance division, which recorded a 767% increase in net income to reach EGP 43mn.” commented Contact Financial Holding management.

The financing division achieved strong results, with operating income growing by 14% y-o-y to EGP 372mn, Additionally, the division’s net profit rose to EGP 27 mn, marking an impressive 33% y-o-y increase compared to the same period last year.

Meanwhile, the insurance division continued to deliver record-breaking results. Insurance revenue surged by 73% y-o-y to reach EGP 619mn during Q1 2025, while gross written premiums (GWPs) grew by 54% y-o-y to EGP 1.07 bn, maintaining exceptional performance supported by strong results across both Sarwa Life and Sarwa Insurance. This growth contributed to a 242% y-o-y increase in the division’s operating income to EGP 109mn, while net income from the insurance division recorded a remarkable 767% y-o-y surge, nearly 9x fold, to c.EGP 43mn.

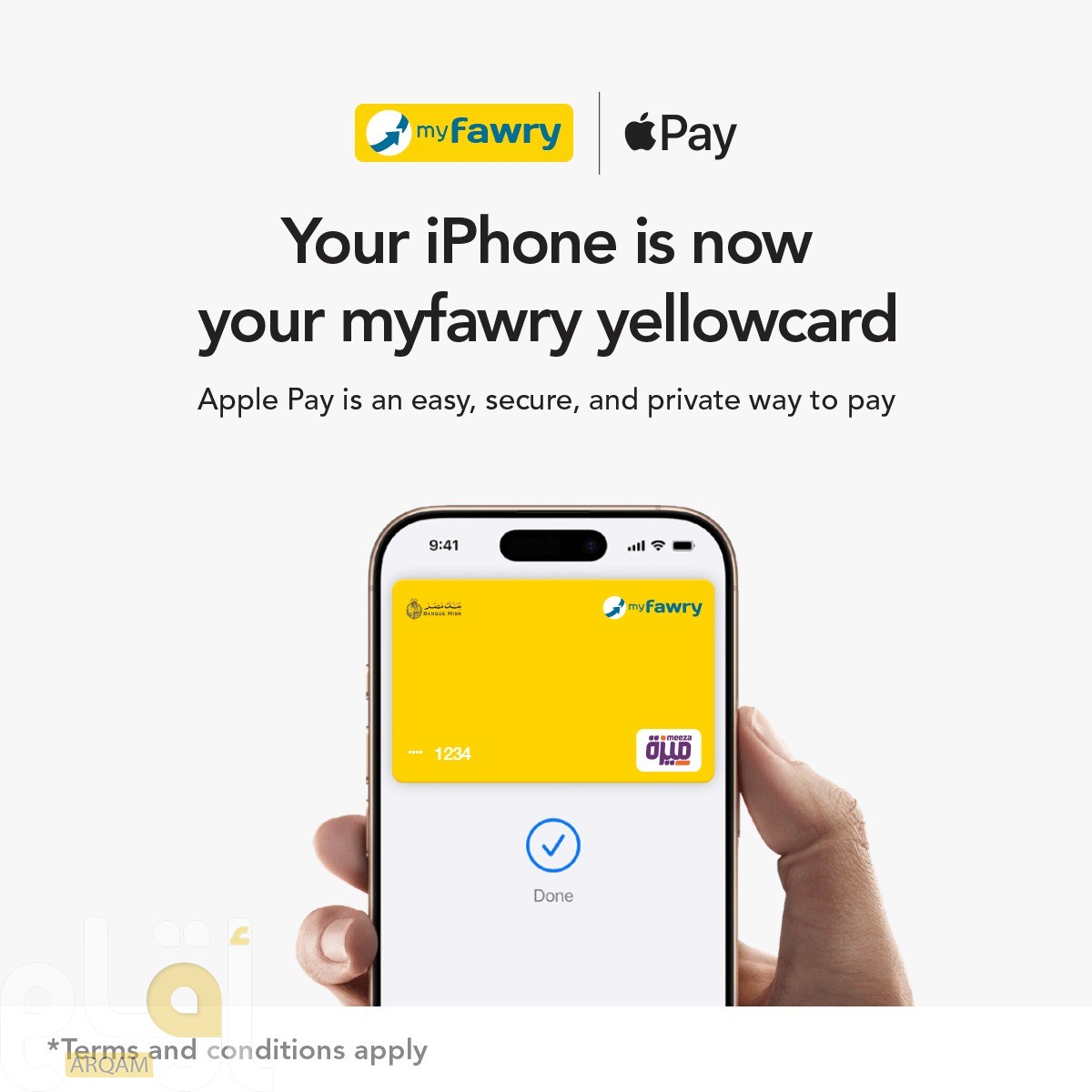

Contact made strong strides in fintech, with ContactNow app, Egypt’s first comprehensive digital financial platform. This momentum reflects the growing demand for Contact’s digital financial solutions. A newly launched purchase journey now empowers customers with access to a broad range of financing products, enabling them to apply for loans directly through the app. Flexible payment options, both cash and installments, are also available, supported by strategic partnerships aimed at streamlining the overall user experience.